WhatsApp)

WhatsApp)

When seeking to do business in China, it is vital to understand the costs associated with customs duty and all import & export tariffs. At Goodada, we have developed a unique Customs Duty Calculator specifically for Chinese customs tariffs in order to enable you to calculate exactly how much you can expect to pay on your next shipment.

Latest China HS Code & tariff for mixing-machine - Tariff & duty, regulations & restrictions, landed cost calculator, customs data for mixing-machine in ETCN. China customs statistics trade data.

Jul 31, 2003· SEAIR Exim provides India import data, Indian customs import database, Indian buyers/importers list, major imported products and Indian ports import data compiled from imports bills of entry filed at Indian customs with shipment details.

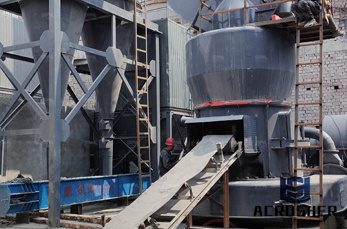

cement plant machinery and parts list . cement plant machinery and parts list Cement Plants Machinery Parts quanzhou fufan block machinery co ltd Dear Sir/Madam we are a professional manufacturer and exporter of Automatic concrete block machine CNC non-vibration hydraulic brick machine ce-cement plant machinery and parts list- Concrete Batch Plant Parts — Parts for Concrete .

General waiver of customs imports duty effective from 23.04.2020 Surcharge on Customs duty effective from 23.04.2020 RPO 03/2020 Special Commodity Levy(SCL) Waiver on Coconut Oil Import Control Regulations No 1 of 2020 SCL changes effective from 17.04.2020 RPO effective from 10.04.2020 SCL changes effective from 10.04.2020

import duty of cementmill machinery parts longriver. import duty of cement mill machinery parts US Customs Import Duty Our goal is to provide the latest and most interesting news, commentary, and information related to import duties, import taxes, and, Import duty and import

Our engine lathe models feature heavy duty bed construction with extra wide bedways and heavy machine weights. All LION Lathes are designed with heavy duty clutched headstocks with hardened and ground gears, which provide the user with ample rigidity for effortless cutting. Spindles feature world renowned SKF bearings, resulting in high accuracy.

excise duty (only for goods which are subject to excise duty, e.g. whisky and wine) Import duty for 13 products that are frequently purchased online. Given below is a list of products that are often bought online outside of the European Union. This table gives an indication of import taxes. See also the Calculation examples.

import duty of cement mill machinery parts. MachiningHeavy Engineering Ltd. We perform Machining of Large Dimension parts at our factory using the following conventional machines Plano Milling/Boring Machine ( X = 6000mm Y = 2500mm Z = 2000mm) with a 3000mm x 3000mm Rotary Indexing Table 40 ton loading capacity and a travel length of 1500mm.

Import Duty Tax Look Up How it works: • To use the Import Duty Tax Look Up, the tariff code of the import must be known. If this is not the case, click on Button 1 to determine the tariff code with our Tariff Code Look Up Tool. • Click on Button 2 to open the Tariff Book. • .

Aug 18, 2010· Customs and duties are a principle source of domestic revenue. Import tariffs are generally assessed on an ad valorem basis, with duties ranging from 0% to 140%. Most primary products, including live animals and fish, enter duty-free. Machinery and goods related to .

Supplier of new parts for Bridgeport Series I Milling Machines, some used parts. We repair, rebuild and retofit mills, lathes grinders, presses, shears, CNC machining Centers and more. Sell used or new machinery by Sharp, Wells-Index, Ellis, Wilton, Jet, Powermatic, Performax. Digital Readouts by Acu-Rite, Anilam, Newall. Power Feeds by Servo, Align.

Ashoka's cement plant unit has continued focused on objectives of product improvement and quality. In our entire turnkey cement plant equipments and machinery, we supply a complete assembly consisting of different machines and equipment, which facilitate the plant to execute efficiently and manufacture a better-quality completed product as per the international quality standards.

Under Export Promotion Capital Goods (EPCG) scheme, a license holder can import capital goods such as plant, machinery, equipment, components and spare parts of the machinery at concessional rate of customs duty of 5% and without CVD and special duty. Table of Contents. Chapter 1 Starting Import .

Grizzly Industrial®, Inc. is a national retail and internet company providing a wide variety of high-quality woodworking and metalworking machinery, power tools, hand tools and accessories. By selling directly to end users we provide the best quality products at the best price to professionals and hobbyists.

View & download of more than 507 Harbor Freight Tools PDF user manuals, service manuals, operating guides. Toy, Automobile Accessories user manuals, operating guides & specifications

Customs duty rates | Australian Taxation Office. We understand the different requirements and equipment being used in the cement plants and can offer same as per your requirement. Similarly design of castings like wear plates, cooler plates, kiln parts, mill liners and pre-heater parts .

The standard equipped Acu-rite MillPwr G2 allows just about any mill operator to machine to machine pockets, islands, contours, and bolt holes. In addition, the easy-to-use conversational programming greatly reduces set up time and machining errors. As a result, better parts and finishes can be produced with less tooling requirements. CNC Bed Mills

Search for import and export commodity codes and for tax, duty and licences that apply to your goods Trade Tariff: look up commodity codes, duty and VAT rates - GOV.UK Skip to main content

This chapter gives an overview of customs VAT, customs duty, Duty 1-2B. Customs VAT, customs duty, Duty 1-2B (Ad valorem excise duties on imports) Table 5.1.11 and table 5.1.2 show the customs value of imports, customs VAT, customs/import duties and excise duties on imports by sector. "Machinery and mechanical appliances, electrical equipment ...

Import duties, at least 80% of tariff lines, are equal to or less than 5% by 1st January 2009, Import duties on ICT products shall be eliminated by 1st January 2010, Import duties on unprocessed agricultural products in High Sensitive List shall have their respective applied MFN rate,

Aug 03, 2012· fittings and mountings intended for permanent installation in or on doors, windows, staircases, walls or other parts of buildings - for example knobs, handles, hooks, brackets, towel .

HS Code Of 84361000, Machinery For Preparing Animal Feeding Stuffs, Indian HS Classification 84361000, Harmonised Code 84361000, Duty Structure Machinery For Preparing Animal Feeding Stuffs

Oct 17, 2017· If the CIF value of the imported goods is USD 1,000, Import Duty is 5%, and the Sales Tax is 12%. Then the duty/taxes calculation is: Import Duty = 5% * USD 1,000 = USD 50. VAT = 12% * (USD 1,000 + USD 50) = USD 126. Total Import Duty and Tax = USD 50 + USD 126 = USD 176

WhatsApp)

WhatsApp)